US-based multinational companies will be exempt from global tax deal

Key Points:

- Nearly 150 countries agreed on an OECD plan to prevent large multinational companies from shifting profits to low-tax countries, but the amended deal exempts large U.S.-based multinationals from the 15% global minimum tax.

- The exemption resulted from negotiations involving the Trump administration and G7 nations, leading to criticism that the deal weakens the original 2021 agreement aimed at curbing tax avoidance.

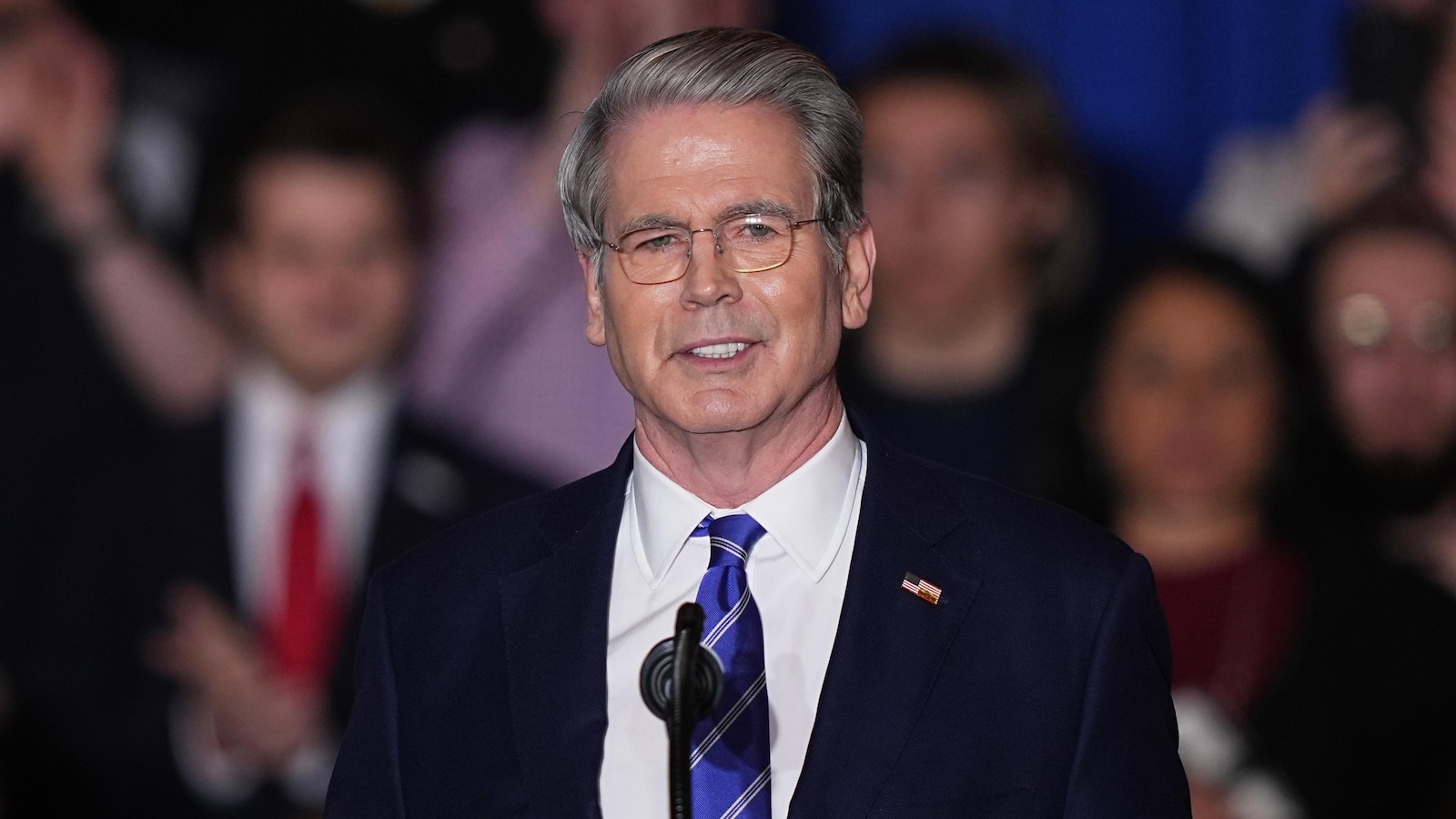

- OECD Secretary-General Mathias Cormann called the agreement a landmark in international tax cooperation, while U.S. Treasury Secretary Scott Bessent praised it as protecting U.S. sovereignty and businesses.

- Tax transparency groups criticized the amended deal for allowing major American companies to continue using tax havens, undermining nearly a decade

:max_bytes(150000):strip_icc()/GettyImages-22400154171-19eb2573d96647f8894478942b5721be.jpg)